Above The Line Deductions List 2024 – Filing Status Taxpayer Is: Additional Standard Deduction 2023 (Per Person) Additional Standard Deduction 2024 (Per Person But you can still claim “above-the-line deductions,” also known . Here is a list of our either the standard deduction or itemized deductions. Before that, you can also make certain adjustments to your gross income by taking above-the-line deductions in .

Above The Line Deductions List 2024

Source : www.nerdwallet.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

C&B Accounting

Source : www.facebook.com

20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet

Source : www.nerdwallet.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

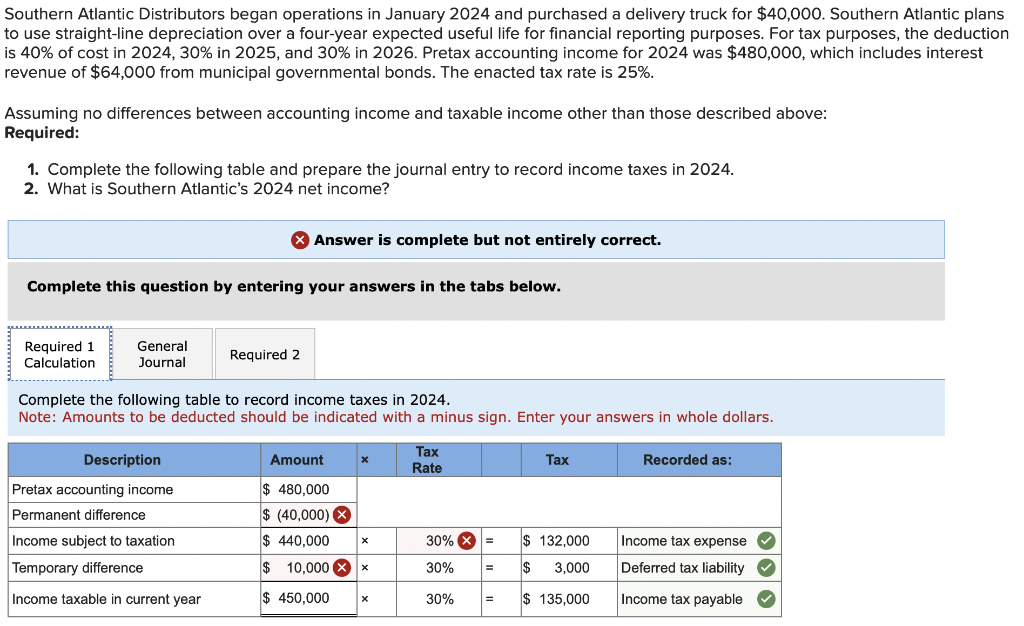

Solved Southern Atlantic Distributors began operations in | Chegg.com

Source : www.chegg.com

New 2024 Mercedes Benz GLE GLE 450 4MATIC® SUV SUV in

Source : www.mbprinceton.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

What Is a Tax Deduction and How Does It Work? Ramsey

Source : www.ramseysolutions.com

Standard Deductions for 2023 2024 Taxes: Single, Married, Over 65

Source : www.forbes.com

Above The Line Deductions List 2024 20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet: The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you . For 2024, the $2,500 maximum deduction for interest paid on qualified education loans will begin to phase out for taxpayers with modified adjusted gross income above $80,000 ($165,000 for joint .